SALVEMOS LOS PEQUEÑOS NEGOCIOS - LA SANGRE VITAL DE NUESTRA ECONOMÍA DE MERCADO

Por Gerald Warner

Nota original: https://reaction.life/save-small-businesses-the-lifeblood-of-our-market-economy/

La ayuda temporaria determinada por el ministro de economía británico, Rishi Sunak, es una concesión bienvenida para una de las partes más vulnerables pero vitales de la economía. Para aquellos negocios que facturen menos de un tope fijado por el ministerio recibirán ayuda del gobierno. Algunos se quejan del corte, y hubieran preferido una escala descendente.

Hay otras medidas en el Presupuesto para ayudar a los pequeños negocios, incluidos créditos para compensar la "interrupción" de la actividad. Esto invita a preguntarse cómo responderán los bancos. Para muchos negocios pequeños, su experiencia previa con los bancos no los dejan tranquilos.

Es hora de que el gobierno y las instituciones financieras creen un clima más amistoso para los pequeños negocios. Las empresas pequeñas o medianas son la espina dorsal de la economía. Son, hoy por hoy, la más pura, destilada, forma de capitalismo que existe, como Adam Smith lo hubiera reconocido. Contrasta con el capitalismo de amigos y las malas praxis de los bancos que provocaron el crash del año 2008.

Si bien es un término usado sin mucha rigurosidad, las empresas pequeñas y medianas se definen en Gran Bretaña por sus ingresos (menos de £25 MM) o por la cantidad de empleados (menos de 250) o por el tamaño de activos (menos de £ 12,5 MM). Son en total 5,8 millones de negocios, dan el 60% del empleo de la nación (con 16,6 millones de trabajadores), y producen la mitad de los ingresos del sector privado, un total de £ 2,2 miles de millones).

Sin embargo, a pesar de su importancia en la economía, las PyMes son maltratadas. El gobierno escucha a las grandes corporaciones porque las grandes corporaciones son las dueñas de la oreja del gobierno, a través de la influencia de lobbistas y organizaciones como la CBI, famosa por haber elegido y advertido erróneamente en cada paso en los últimos 30 años, desde la supuesta necesidad de incorporarse al euro y abandonar la libra hasta el imaginado desastre que iba a producir el Brexit.

Las PyMes (SMEs en GB) tienen una existencia precaria: sólo el 47% de los negocios sobreviven más de cinco años. Por supuesto, en muchos casos la quiebra es debido al natural proceso del capitalismo, desechando empresas inviables. Pero hay muchos casos en donde empresas viables son subvertidas por factores que no se reflejan en su competitividad. Probablemente los dos azotes más opresivos son los trámites (red tape) y los problemas de falta de disponibilidades causados por el retraso en los cobros.

La regulación es necesaria para sostener un capitalismo ético. Pero tanto su carácter como su distribución ha sido a menudo distorsionados. Las regulaciones de las prácticas bancarias pre-2008 eran notoriamente laxas, mientras, simultáneamente, los pequeños negocios se desempeñaban bajo una gigantesca carga de trámites (red tape) - regulaciones directas de la Unión Europea, regulaciones de la Unión Europeas aprobadas por el Parlamento Británico, burocracia doméstica - que deben de habre contribuido significativamente a las quiebras de los negocios.

Aún en los años del thatcherismo cuando supuestamente prevaleció una cultura británica de negocios, trabajo duro y profesionalismo no necesariamente garantizaba el éxito de una firma. Tomemos, por ejemplo, el perfil clásico de un muy pequeño negocio, probablemente manejado por un equipo de marido y mujer, él a cargo de las operaciones, ella llevando los libros. Si iban a un banco a pedir un crédito, el resultado más probable era que le prestaran sólo un porcentaje de la suma requerida.

Considerando, de mala gana, que eso era mejor que nada, los dueños tomarían un financiamiento inadecuado, dejándoles descapitalizados o subcapitalizados y además con el cargo de intereses y capital del préstamo. El matrimonio se esfuerza, con el correlato de ataques al corazón y úlceras, y en el momento crítico, el banco se retira y exige la cancelación del total, liquidando otro negocio viable pero sin liquidez. Bonos para todos los verdugos (oficiales de recuperos).

No está tan lejos en la memoria la irresponsabilidad bancaria del año 2008. La relación entre los prestamistas y los negocios es frecuentemente poco feliz y a veces de abuso.

...

[Esa conducta se mantuvo aún] luego de que - supuestamente - el sistema bancario fuera reformado y se convirtiera en aburridamente ético. Por lo tanto, no es de sorprender que los pequeños propietarios permanezcan escépticos en cuán efectiva puede ser la ayuda prometida por el ministro en forma de préstamos que será implementados a través del sistema bancario y mucho menos sobre las tasas de interés que cobrarán.

No están los bancos solos en aprovecharse de los pequeños negocios. Vemos muchas lágrias de cocodrilo vertidas por políticos locales, deplorando la desolación de las calles principales, cuando los gobiernos locales frecuentemente impuestos punitivos sobre las propiedades comerciales que provocan que las empresas huyan cuando no las pueden pagar.

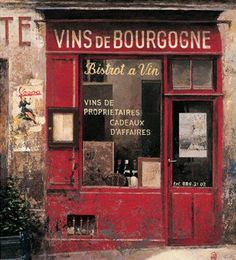

En el reino de la primera Isabel, el capitalismo se expandió por los comerciantes aventureros; en el actual reino el equivalente puede ser abrir un pequeño negocio de estacionamiento o una tienda de reparación de electrodomésticos, u otro de los miles de negocios similares. El capitalismo es duro y el fracaso está a un paso del esforzado emprendedor. Pero aún así la gente lo intenta y la economía nacional se beneficia.

Las PyMes contribuyen enormemente al crecimiento de la economía, generando oportunidades de empleo aún en las áreas más deprimidas, creando competencia e innovación, y han demostrado una y otra vez responder y adaptarse más rápidamente a los cambios de los ciclos económicos.

Debemos entender su valor y promover un clima favorable a su éxito. Las PyMes no son los parientes pobres de las grandes corporaciones; son las más directas herederas de la conducta capitalista como las imaginó el autor de La Riqueza de las Naciones.

* * *

Save small businesses – the lifeblood of our market economy

BY GERALD WARNER / 12 MARCH 2020

The temporary relief granted to small businesses by the chancellor, Rishi Sunak, is a welcome concession to one of the most vulnerable but vital parts of the economy. A business rates “holiday” for companies with a rateable value of less than £51,000 will grant a valuable breathing space to struggling firms, though some will argue that the £51k cut-off point is too arbitrary and it might have been preferable to have implemented relief on a sliding scale.

There were other measures in the Budget to help small business, including access to “business interruption” loans to help in the current crisis. That invites the question of how fairly the banks will operate to ensure businesses benefit. For embattled SMEs, some past experiences in their dealings with banks are not reassuring.

It is high time the government and financial institutions created a more friendly climate for SMEs. Smaller to medium enterprises are the backbone of the economy. They are the purest distillation today of capitalism as Adam Smith would have recognised it, in contrast to the crony capitalism and malpractice by banks that provoked the crash of 2008.

Although the term is loosely used, small and medium-sized enterprises are defined in the UK as businesses with turnovers of less than £25m, fewer than 250 employees, or gross assets of less than £12.5m. They account for 5.8 million businesses, 60 per cent of employment (with 16.6 million employees) and half of private-sector turnover, amounting to £2.2 trillion.

Yet, despite their importance to the economy, SMEs have been poorly treated. Government listens to large corporations because they have its ear, through the influence of lobbyists and organisations such as the CBI, famous for having got every call wrong in the past 30 years, from the supposed need to join the euro to the imagined disaster of Brexit.

Yet, despite their importance to the economy, SMEs have been poorly treated. Government listens to large corporations because they have its ear, through the influence of lobbyists and organisations such as the CBI, famous for having got every call wrong in the past 30 years, from the supposed need to join the euro to the imagined disaster of Brexit.

SMEs have a precarious existence: only 47 per cent survive beyond five years. Of course, much of that attrition is due to the natural processes of capitalism, culling enterprises that are non-viable. But there are also many instances where viable enterprises are subverted by factors that do not reflect on their competitiveness. Probably their two most oppressive scourges are red tape and cash flow problems caused by late payments.

Regulation is necessary to sustain ethical capitalism. But its character and distribution have often been badly distorted. Regulation of banking practices pre-2008 was notoriously lax, yet simultaneously small businesses were labouring under a burden of red tape – direct EU regulations, EU regulations rubber-stamped by Westminster, domestic bureaucracy – that must have contributed significantly to business failures.

Regulation is necessary to sustain ethical capitalism. But its character and distribution have often been badly distorted. Regulation of banking practices pre-2008 was notoriously lax, yet simultaneously small businesses were labouring under a burden of red tape – direct EU regulations, EU regulations rubber-stamped by Westminster, domestic bureaucracy – that must have contributed significantly to business failures.

Even in the years when Thatcherism supposedly prevailed in the British business culture, hard work and competence did not necessarily guarantee the success of a firm. Take the classic profile of a very small business, perhaps run by a husband and wife team, he heading the daily operations, she keeping the books. If they approached a bank for a loan, a typical outcome was for the bank to lend only a percentage of the sum requested.

Reluctantly regarding this as better than nothing, the owners would take that inadequate financing, leaving them under-capitalised and burdened with interest payments. As the couple struggled, acquiring heart attacks and ulcers in the process, when the most critical moment arrived the bank would pull the plug, liquidating yet another viable but cash-starved enterprise. Bonuses all round for the executioners.

That is not just a distant memory of pre-2008 banking irresponsibility. The relationship between lenders and business has frequently been unhappy and sometimes exploitative. The most notorious example was the Global Restructuring Group (GRG) set up by RBS to help restructure small businesses in the wake of the downturn, between 2008 and 2013.

After complaints and an investigation, the FCA produced a redacted report which the House of Commons Treasury committee published unredacted under parliamentary privilege. It revealed that GRG had inflicted “material financial distress” on small businesses, 12,000 of which were drawn into the system. A GRG training memo written in 2009 was obtained by the BBC and later published by the Treasury Committee; it was headed “Just Hit Budget”.

It advised RBS staff “how to get a customer to agree chunky fees and upsides and thank you for it”. Businesses in severe distress were described as “Basket cases. Time consuming but remunerative.” A section headed “Rope” advised: “Sometimes you need to let customers hang themselves. You have then gained their trust and they know what’s coming when they fail to deliver.” On fees: “Be specific: avoid round number fees – £5,300 sounds as if you have thought about it. £5k sounds like you haven’t.”

That is not just a distant memory of pre-2008 banking irresponsibility. The relationship between lenders and business has frequently been unhappy and sometimes exploitative. The most notorious example was the Global Restructuring Group (GRG) set up by RBS to help restructure small businesses in the wake of the downturn, between 2008 and 2013.

After complaints and an investigation, the FCA produced a redacted report which the House of Commons Treasury committee published unredacted under parliamentary privilege. It revealed that GRG had inflicted “material financial distress” on small businesses, 12,000 of which were drawn into the system. A GRG training memo written in 2009 was obtained by the BBC and later published by the Treasury Committee; it was headed “Just Hit Budget”.

It advised RBS staff “how to get a customer to agree chunky fees and upsides and thank you for it”. Businesses in severe distress were described as “Basket cases. Time consuming but remunerative.” A section headed “Rope” advised: “Sometimes you need to let customers hang themselves. You have then gained their trust and they know what’s coming when they fail to deliver.” On fees: “Be specific: avoid round number fees – £5,300 sounds as if you have thought about it. £5k sounds like you haven’t.”

Last year the FCA published its final conclusions on the matter, while emphasising that most GRG activity was outside the scope of FCA regulation: “… the conclusion of the independent review was that there was systemic and widespread inadequate conduct within GRG. Our investigation has found that GRG clearly fell short of the high standards its customers expected. That said, our investigation also concluded that the evidence does not suggest that management sought to treat customers unfairly.”

GRG occurred post-Fred Goodwin when RBS and the rest of the banking system was supposed to be reformed and almost boringly ethical. So, it would not be surprising if small business owners today remain sceptical of how effectively the chancellor’s assistance in the form of loans of up to £1.2m will trickle down to them via lenders and at what level of interest rates.

Nor are banks alone in preying upon small businesses. We see far too many crocodile tears being shed by local politicians, deploring the desolation of their high streets, when local government has frequently imposed such punitive business rates on commercial premises that enterprise flight became inevitable.

In the reign of the first Elizabeth, capitalism was expanded by merchant adventurers; in the current reign the equivalent may be somebody opening a small garage and repair shop, or any one of thousands of similar small-scale enterprises. Capitalism is tough and failure is never more than a step behind the striving entrepreneur. But still people do it and the national economy is the beneficiary.

SMEs contribute hugely to economic growth, generate employment opportunities even in depressed areas, create competition and innovation, while they have been shown to respond and adapt more quickly to changes in the economic climate.

We should value them and promote a climate favourable to their success. SMEs are not the poor relations of large corporations: they are the most direct heirs of capitalist endeavour as envisioned by the author of The Wealth of Nations.

Nor are banks alone in preying upon small businesses. We see far too many crocodile tears being shed by local politicians, deploring the desolation of their high streets, when local government has frequently imposed such punitive business rates on commercial premises that enterprise flight became inevitable.

In the reign of the first Elizabeth, capitalism was expanded by merchant adventurers; in the current reign the equivalent may be somebody opening a small garage and repair shop, or any one of thousands of similar small-scale enterprises. Capitalism is tough and failure is never more than a step behind the striving entrepreneur. But still people do it and the national economy is the beneficiary.

SMEs contribute hugely to economic growth, generate employment opportunities even in depressed areas, create competition and innovation, while they have been shown to respond and adapt more quickly to changes in the economic climate.

We should value them and promote a climate favourable to their success. SMEs are not the poor relations of large corporations: they are the most direct heirs of capitalist endeavour as envisioned by the author of The Wealth of Nations.